What it takes to be successful in K-12 EdTech

The 2020 Australian K-12 EdTech Whitepaper

Greenwich Capital Partners & EduGrowth

November 2020

The Australian K-12 education sector trails behind other sectors in the adoption of digital resources. We believe this is about to change. But like the e-commerce companies of the dotcom era, not all of today’s EdTech companies will be winners.

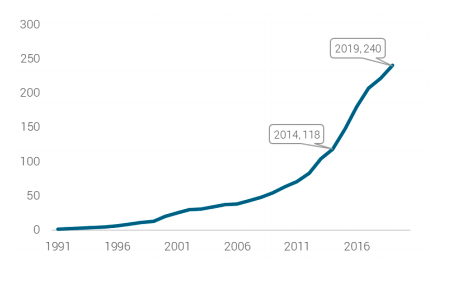

There are a number of factors that have contributed to the state of K-12 EdTech in Australia being more transformative than ever before. As a result of the COVID-19 pandemic, K-12 education has been pushed into adopting new digital technologies in order to support remote learning. 240 EdTech companies target K-12 schools, which is approximately 40% of Australia’s EdTech sector. There’s a new generation of parents and students who have a digital-first mindset and expect education to be delivered in methods that are seamless and personalised.

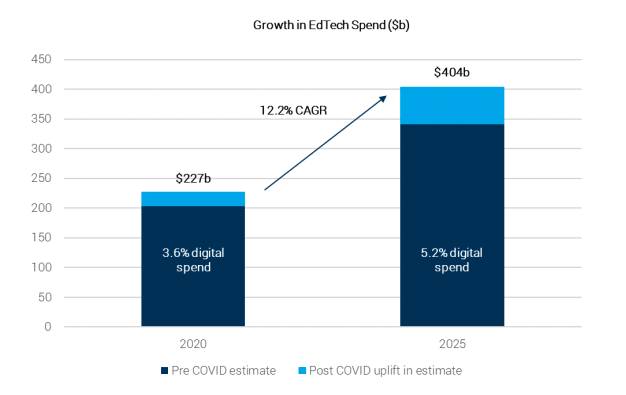

Figure 2. Digital expenditure as a proportion of overall expenditure on global education and training, including the expected uplift from the COVID-19 pandemic (source: HolonIQ)

The aim was to survey the current landscape of the Australian K-12 EdTech sector, in order to observe past, present and future trends. The questions asked when creating developing this research were:

Why is now the time to invest into the Australian K-12 EdTech sector?

How can EdTech companies win market share and create a sustainable business model during times of rapid growth?

The following are key recommendations for EdTech companies:

- EdTech companies need to focus on building a differentiated product that encompasses data privacy, learning analytics, and implementation support.

- To break through the challenges with selling to schools, it is crucial to have a sophisticated sales and marketing model that uses sales technology, dedicated sales professionals, and teachers as advisers.

- To expand the addressable market, EdTech companies need to be deliberate about which international markets to enter and how to compete.

- Consider a consolidation play in the sector: a roll-up company will improve sales productivity, guard against external threats, take advantage of big opportunities, and compete for the best talent.

- With more companies and the emergence of Big Tech in the classroom, understand your value proposition and product position in a competitive landscape.

The highlights for investors considering K-12 EdTech investment are:

- K-12 schools are adapting their curriculums, because relevant technology proficiency will enable a future-ready workforce and meet the evolving expectations of parents and students.

- COVID-10 accelerated pre-existing education sector trends, such as the adoption of technology in schools, the rollout of infrastructure to enable that technology, and the growth of the B2C model.

- These factors suggest that EdTech access is moving from early-adopters to the mass market. The global EdTech market is estimated to grow 12.2% over the next five years, reaching $404 billion in total expenditure.

- Australia is well-positioned to take advantage of this growth because of its rigorous use of evidence-driven strategies and stable government funding.

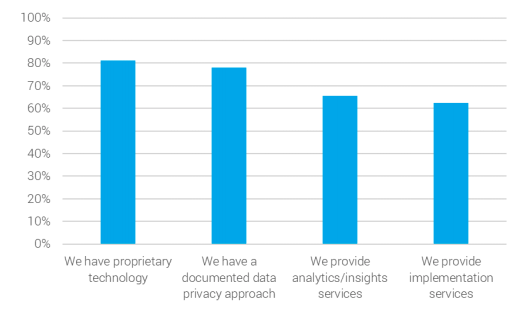

Figure 6. Percentage of EdTech companies surveyed that have each product quality component

Register to download report

Note: this page will refresh on submit to reveal the download link