Introduction

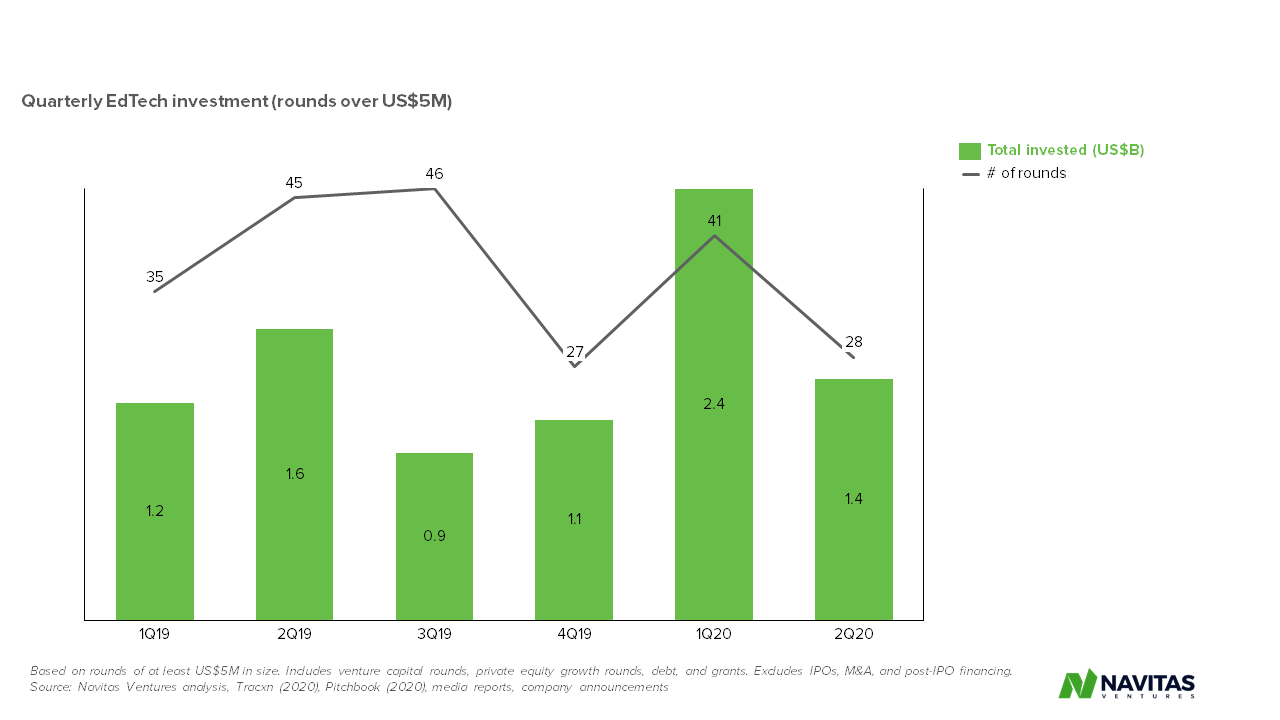

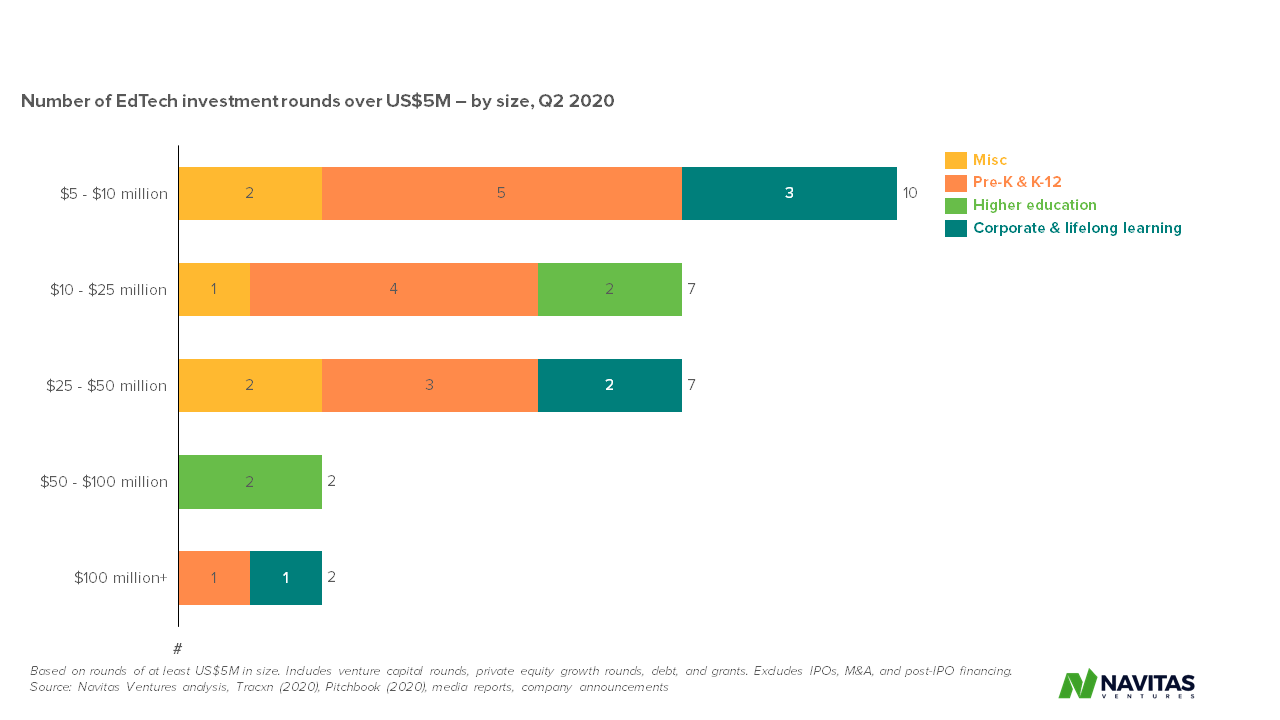

Navitas Ventures counted 28 funding rounds of US$5M or more during the quarter. This includes venture capital rounds, private equity growth rounds, debt, and grants; it excludes IPOs, M&A, and post-IPO fundraising by listed companies.

Collectively, these were worth US$1.4B. This broke down as follows:

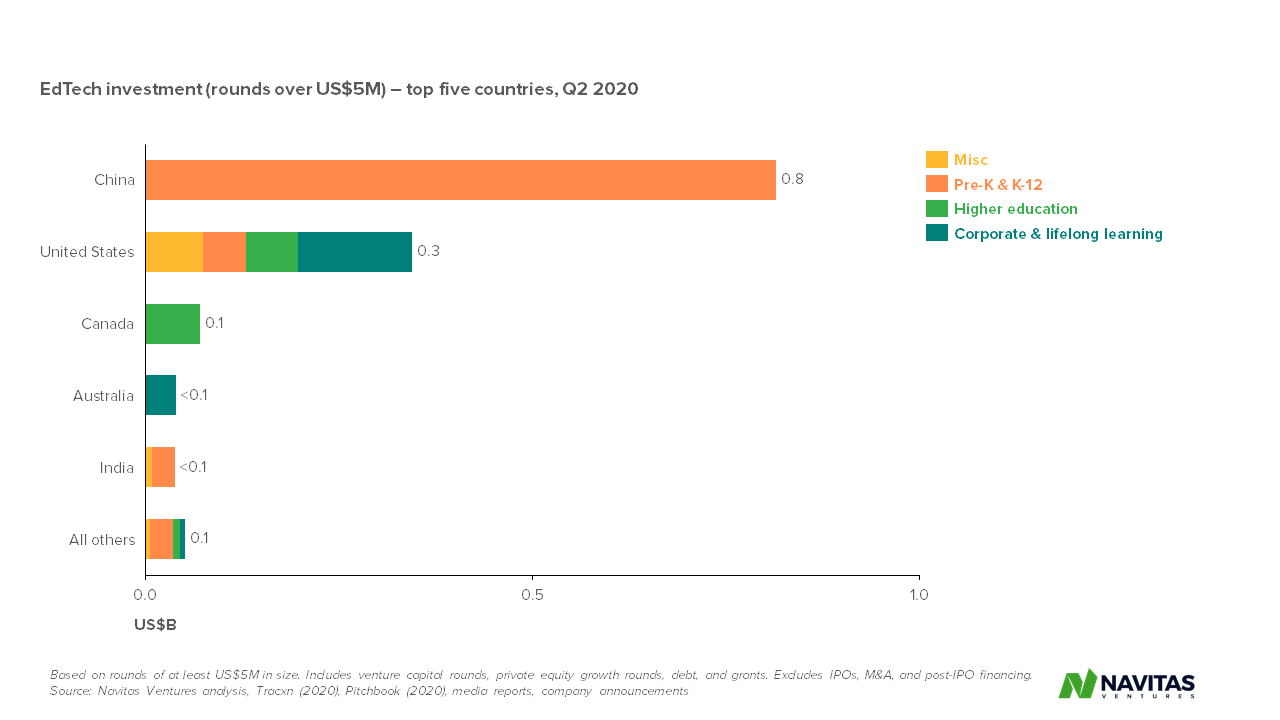

- US$0.9B in emerging markets;

- US$0.5B in developed markets.

Our headline figures are down significantly from the June quarter of 2019, when we recorded US$1.6B of fundraising spread across 45 transactions.

The difference between the decline in dollars (17%) and the decline in volume (38%) reflects a very large (US$750M) Chinese round at the end of the June 2020 quarter – about which more below. If this is removed, funding would have fallen 63% in dollar terms, and developed markets would dominate the quarter.

At the same time, usage of many EdTech products has increased in recent months. To the extent that this translates into sustained momentum, this may prove more valuable over the long run.

Notable Global Deals

The largest round of the quarter was Zuoyebang’s US$750M series E round, announced at the end of June. This is the second largest fundraising round in EdTech history, after the US$1B round that Yuanfudao announced in March.

Apart from this, North American post-secondary companies dominated the remaining fundraising for the quarter.

- In May, Masterclass (US) raised a US$100M Series E round led by Fidelity.

- In May, ApplyBoard (Canada) announced that it had raised C$100M led by Drive Capital.

- In May, Benchling (US) raised US$50M led by Alkeon.

- In June, Noodle Partners (US) raised a US$16M Series B round led by the ValueAct Spring Fund. While not one of the largest rounds of the quarter, it stands out for its topicality – Noodle helps universities launch online degrees.

Notable Australian Deals

In May, GO1 raised a US$40M Series C round led by Madrona Venture Group and SEEK. This is the latest in a series of rounds, beginning in 2019, in which investors have put significant sums into Australian corporate & lifelong learning EdTech companies.

Notable Exits

In June:

- We saw an exit close to home when Five V Capital’s Fund III acquired a majority stake (paywall) in Totara, the New Zealand-based provider of a corporate LMS. Consideration was reported to be over A$50M.

- Chegg acquired Mathway, the provider of an online maths problem-solving tool. Consideration was US$100M cash (approx 7.7x 2019 net revenue of US$13M) plus up to US$15M in earn-outs over the next three years.

This EdTech Investment Blog was written by Peter Sahui.

Peter is a venture capital and investment research professional with over 10 years’ experience. Peter has an MBA from AGSM and is a CFA charterholder.