Introduction

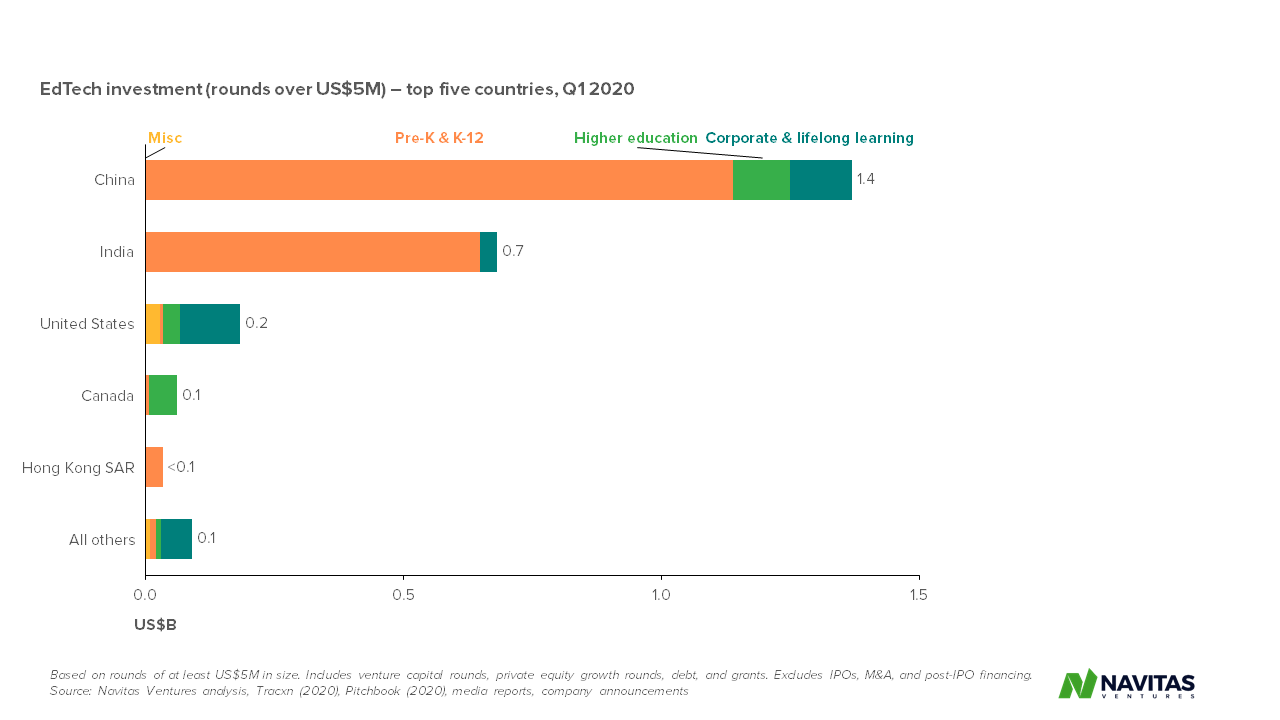

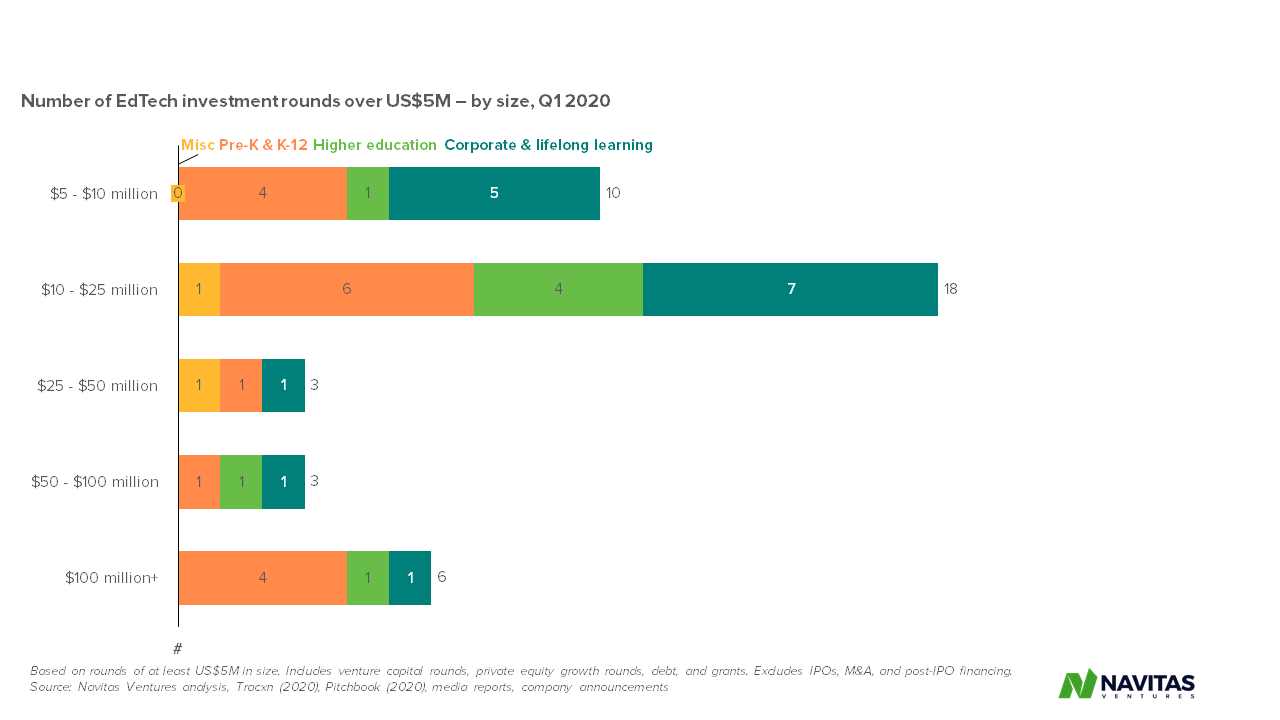

During the March quarter, Navitas Ventures counted 40 funding rounds of US$5M or more. This includes venture capital rounds, private equity growth rounds, debt, and grants; it excludes IPOs, M&A, and post-IPO fundraising by listed companies.

Collectively, these were worth US$2.4B:

- US$2.1B in emerging markets – driven by a small number of extremely large K-12 rounds;

- US$0.3B in developed markets.

While this is a large headline number — for context, we counted US$5B for the whole of 2019 — it is also lumpy and includes large rounds that took place early in the quarter.

The real effect of COVID-19 will be seen later in the year. A decline in venture capital — and, by extension, EdTech — investment looks likely, as does a decline in startup valuations. Such a decline could potentially continue into 2021; following the GFC, it took about a year before venture capital investment troughed in 2009.

Notable Global Deals

The quarter was dominated by large fundraising rounds by companies based in China and India.

As in previous years, these were mostly in the K-12 sector:

- Yuanfudao, a Chinese online education company, raised US$1B at a US$7.8B valuation at the end of March.

- To our knowledge, this is the largest EdTech round in the history of the sector.

- The company has also experienced significant interest in its product — 5 million students reportedly (paywall) took up an offer of free live classes in February.

- Byju’s, the best funded EdTech company in India, raised an estimated US$400M to US$500M over January and February.

- Unacademy raised US$110M in February, led by General Atlantic, Facebook, and Sequoia India. This comes soon after it raised US$50M in mid-2019.

China also saw a couple of large post-secondary transactions in January, with Yunxuetang (corporate training) and Wanxue Education (test prep and admissions consulting) raising US$100M each.

Developed markets transactions were concentrated in the post-secondary space:

- Top Hat (Canada) raised a US$55M round led by Georgian Partners and Inovia Capital in February.

- Udemy (US) raised US$50M from Benesse, a Japanese strategic investor, in February.

- Strivr (US), a provider of VR-based training solutions, raised a US$30M round led by Georgian Partners in March.

- Le Wagon (France) raised a €17M (US$19M) round led by Cathay Capital in March.

Notable Australian Deals

Two Australian companies raised funds to support their international expansion:

- Zookal, the operator of an online store for textbooks, raised an A$15M (US$9.7M) Series B round in March – proceeds will be used for Southeast Asian expansion. Koh Boon Swee and Bernard Sabrier led the round.

- Newcastle-based corporate LMS developer Coassemble raised an A$4.4M (US$2.9M) Series A round in February – proceeds will be used for US expansion. Notably, this is one of the few deals to take place outside a metro area. Equity Venture Partners led the round.

Notable Exits

International

There were several significant acquisitions during the quarter:

- Thoma Bravo, a private equity firm specialising in the tech sector, completed its acquisition of Instructure (the parent company of the Canvas LMS) in March.

- Cornerstone, a corporate LMS provider, acquired Saba for US$1.4B in cash and stock in February.

- K12, a US-based provider of virtual schools, acquired Galvanize, a bootcamp provider, for US$165M in January. The purchase price represents 3.3x estimated 2020 revenues of US$50M.

- This represents another example of consolidation in the B2C bootcamp sector. It also offers another data point for bootcamp valuations, alongside General Assembly (4.1x 2017 actual revenue) and Trilogy (5.6x estimated 2019 revenue – though this was written down shortly afterwards).

Australia

Two venture-backed Australian EdTech companies exited:

- TSG acquired Xplor (backed by Airtree Ventures and others) on undisclosed terms. The deal was announced in December 2019 and completed in February.

- Pearson acquired the assets of Smart Sparrow (backed by OneVentures and others) for US$25 million in January.

Peter is a venture capital and investment research professional with over 10 years’ experience. He works as a Senior Associate at Navitas Ventures. Peter has an MBA from AGSM and is a CFA charterholder.