The Australian EdTech Market Census 2019

Accelerating to meet escalating demand

The Australian EdTech Census 2019

Deloitte & EduGrowth

February 2020

EduGrowth are delighted to partner with Deloitte for the Australian EdTech Market Census. EduGrowth conducted the Australian EdTech Market Census in 2019. With the data collected through that Census, EduGrowth and Deloitte have collated the findings into insights and related commentary found in this report.

Population growth and skills are driving exponential demand

Population growth in developing markets is driving a mass expansion in, and demand for, education services. At the same time, digital disruption in developed economies is driving unprecedented reskilling and upskilling, which in turn is also driving demand for rapid innovation and the scaling of education services targeted toward emerging industry needs.

EdTech offers a solution

EdTech refers to the application of technology across the education value chain: from the discovery of learning through to completion and credentialing.

Most solutions address the specific needs of learners, employers or education providers; while others seek to enable better connections between these three groups. However, EdTech also extends beyond learning, with solutions to support researchers and administrators of educational services.

EdTech innovations have the potential to transform education through advanced technologies such as AR/VR; AI; robotics; and blockchain. These technologies can better connect education with the learning needs of student and employees, and they can do so at speed and at scale. For example, innovations such as AI-enabled hyper-personalisation can allow teachers and trainers to better cater to the specific needs of their individual students.

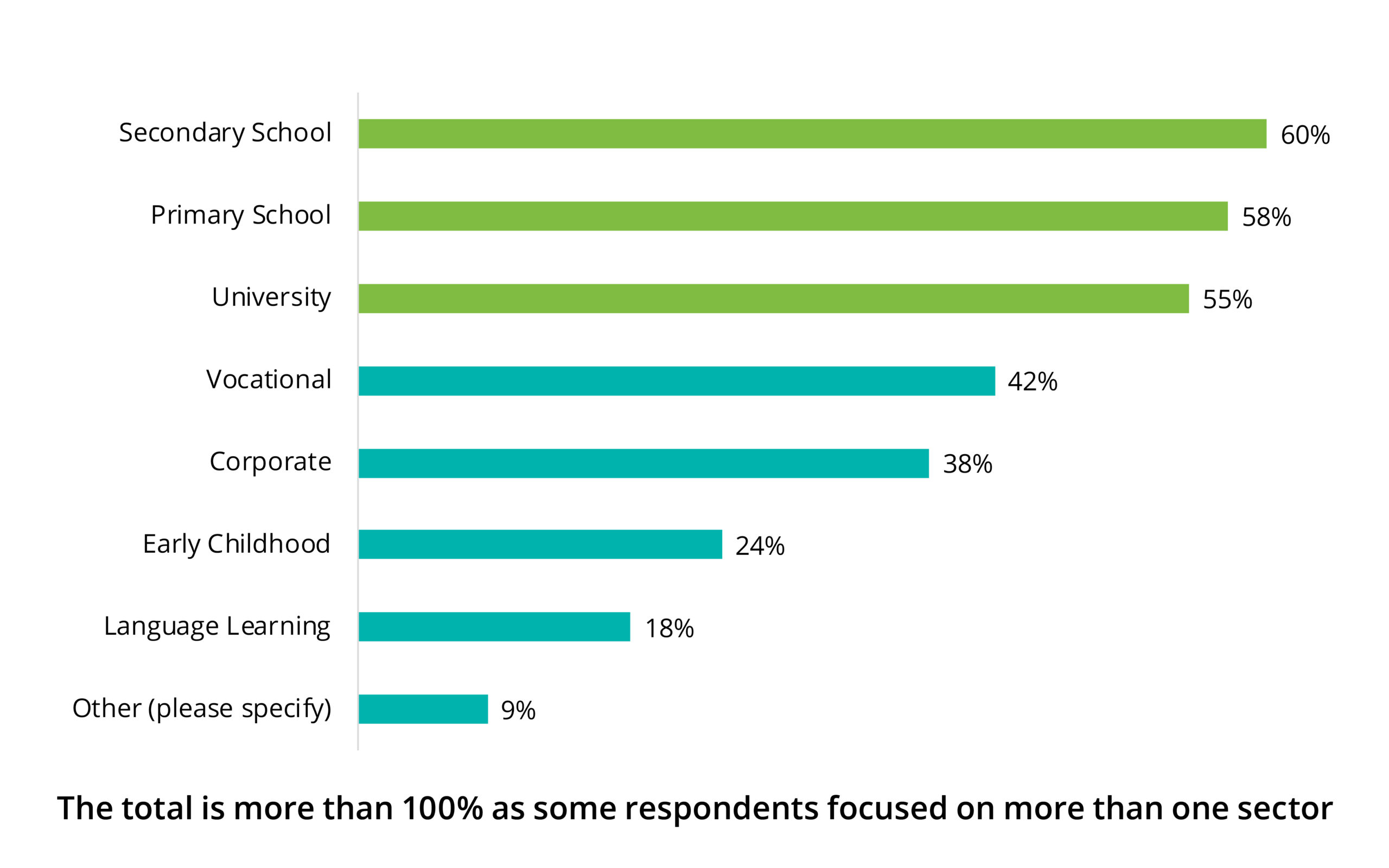

EdTech solutions targeting schools and universities lead, but the future of work is gaining traction

The majority of Australian EdTech organisations focus on primary and secondary schools, and universities.

However, the percentage of organisations focused on corporate and vocational learning products has increased (from 24% to 38% from 33% to 42%, respectively) since 2017. This shift in focus indicates that future or work solutions are increasingly in the frame.

Good examples are G01, which provides a marketplace of training options connecting employers and training providers, and A Cloud Guru, which provides cloud computing training to help organisations train employees and transition to a cloudbased environment.

In 2019, these two Australian organisations raised the largest levels of funding (through funding rounds) that the Australian EdTech sector has ever seen.

Global markets are growing

The global market for EdTech is rapidly expanding, with forecasts predicting that expenditure on EdTech will reach $341bn in 20253. Recognising the opportunity, investors are keen to participate. Global venture capital investments in EdTech reached $7bn in 2019, up from $500 million in 20104.

In the context of this global growth and the evolution of the EdTech sector, EduGrowth first launched the Australian EdTech Census in 2017. The Census seeks to map the landscape, track progress, and identify ways to help foster innovation in the EdTech sector.

The 2019 Census aims to identify how the sector has evolved over the last two years. The Census has a total of 168 repondents, of whom 116 are running an EdTech organisation. For context, EduGrowth estimates that there are approximately 600 EdTech organisations in Australia.

Australia’s EdTech sector has momentum, but we need to do more

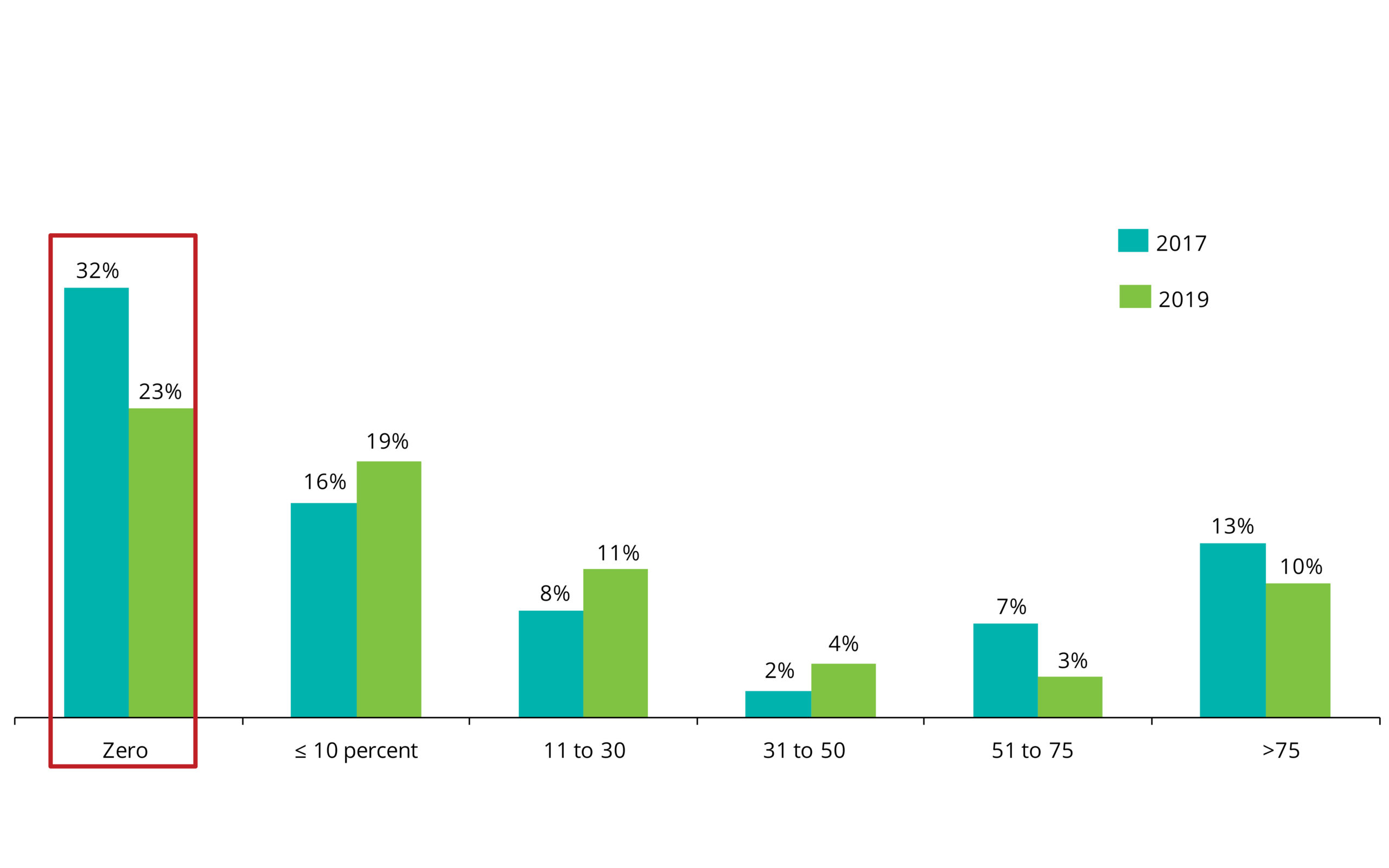

The Australian EdTech market is maturing. Between 2017 and 2019, the Australian EdTech sector grew significantly, almost doubling in size. Over this period, a greater number of EdTech organisations have also progressed from ‘start-ups’ to ‘scale-ups’. The key features of a scale-up are that they have progressed from concept to the delivery of one or more education services. They also have established customer bases and ongoing monthly revenue streams.

This is simultaneously encouraging and insufficient: to compete in an increasingly innovative and competitive global education market, we must do more in Australia.

China made up 53% of the last decade’s EdTech funding, the US made 33% followed by Europe and India at around 5% each. Australia is one of the countries in the ‘rest of the world’ category that makes up the remaining 5% of global funding. Similarly, of the 14 global EdTech unicorns (with a market valuation over $1 billion), all are based in the US, China and India4.

We have a well-funded sector in Australia in keeping with our size and scale, but if we want to be part of the future we must collaborate to further stimulate, support and scale local EdTech initiatives. Businesses, education providers and policy makers all have a role to play to help Australian organisations prosper, and to ensure our EdTech sector continues to grow.